Principal 401k calculator

It is calculated by multiplying the principal amount to the compounding interest further calculated by one plus rate of interest to the periods power. When calculating board feet you are determining what the total volume of wood you have is.

How To Use The Excel Cumprinc Function Exceljet

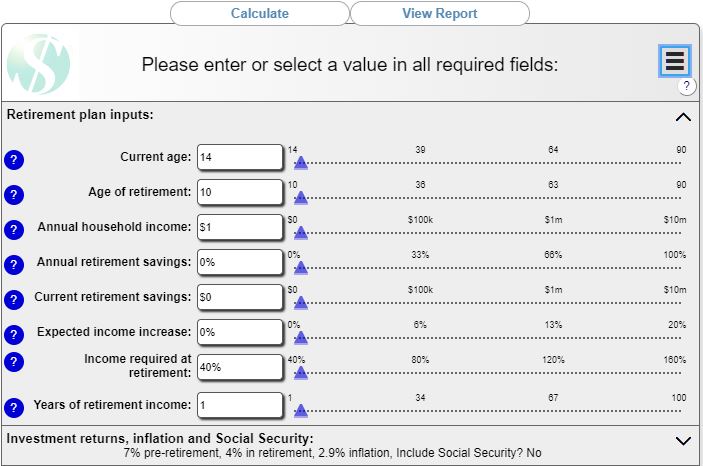

This first calculator shows how your balance grows during your working years.

. The general rule is that you can afford a mortgage that is 2x to 25x your gross income. Keep in mind that investments in a 401k are subject to market risk including the potential to lose the entire principal amount invested. Length of Time in Years.

Lets assume the following. The actual rate of return is largely dependent on the types of investments you select. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match.

ASCII characters only characters found on a standard US keyboard. You simply enter the length width and thickness of your boards and how many of them you have to easily determine the total number of board feet. Helping individuals and institutions improve their financial wellness through life health insurance retirement services annuities and investment products.

The Growth Chart and Estimated Future Account Totals box will update each time you select the Calculate or Recalculate button. We assume you will live to 95. Your principal may be subject to taxes on dividends and capital gains as it grows.

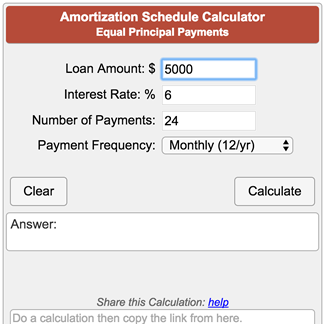

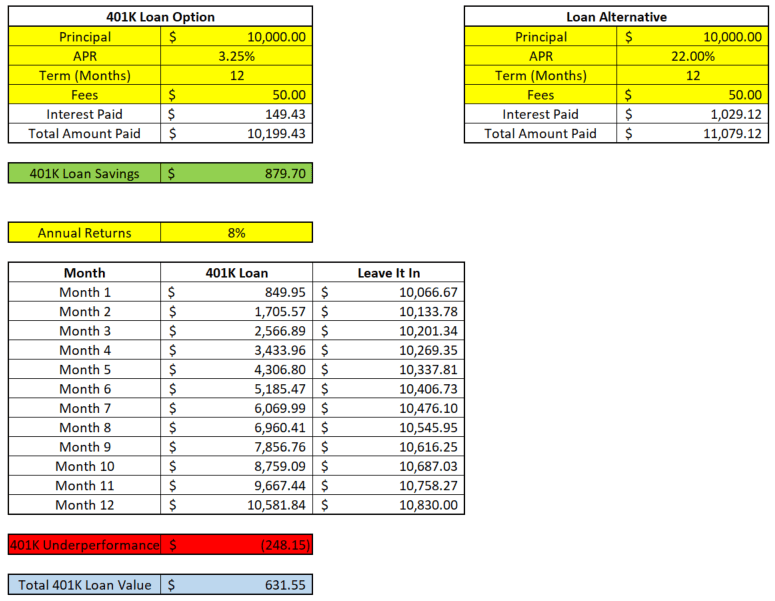

The interest is paid into the 401k account as well as the principal. It typically ranges from 1 to 5 of the loan amount. A 401k loan calculator that allows one to enter data for a new or existing 401k to determine ones payment.

Home financial 401k calculator. It is possible to see this in action on the amortization table. We stop the analysis there regardless of your spouses age.

Origination feeSometimes called an application fee it helps to cover costs associated with processing applications. Inflation the rate at which the general level of prices for goods and services is rising and subsequently purchasing power is falling. Aside from the typical principal and interest payments made on any type of loan for personal loans there are several fees to take note of.

Simple 401k Calculator Terms Definitions 401k a tax-qualified defined-contribution pension account as defined in subsection 401k of the Internal Revenue Taxation Code. Participants should regularly review their savings progress and post-retirement needs. Individual results will vary.

401k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Print Use this calculator to estimate how much in taxes you could owe if you take a distribution before retirement from your qualified employer sponsored retirement plan QRP such as a 401k 403b or governmental 457b. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. 401k O 1i.

We assume that the contribution limits for your retirement accounts increase with inflation. The Board Foot Calculator is a simple online tool for calculating board feet without a complicated formula. Amount of money that you have available to invest initially.

Responsibility for those decisions is assumed by the participant not the plan sponsor and not by any member of Principal. The bruce treadmill test calculator exactly as you see it above is 100 free for you to use. Total monthly mortgage payments are typically made up of four components.

A Roth 401k gives you a similar tax me once advantage except that you get taxed at the beginning rather than the end. What Could Your 401k Be Worth at Retirement. You are 30 years old right now.

The principal value and. Expenses for the repair of damage to a principal residence. Length of time in years.

Rental price 70 per night. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years. This calculator assumes that your return is compounded annually and your deposits are made monthly.

The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. A part of the payment covers the interest due on the loan and the remainder of the payment goes toward reducing the principal amount owed. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck.

6 to 30 characters long. Principal interest taxes and. 401K and other retirement plans.

Here we discuss how to calculate the contribution amount of the 401k account of an individual along. This has been a guide to the 401k contribution calculator. GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path.

If you return the cash to your IRA within 3 years you will not owe the tax payment. Must contain at least 4 different symbols. One can enter an extra payment and a rate of depreciation as well to see how a 401ks value may decrease.

401k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Print Use this calculator to estimate how much in taxes you could owe if you take a distribution before retirement from your qualified employer sponsored retirement plan QRP such as a 401k 403b or governmental 457b. Click the Customize button above to learn more. We automatically distribute your savings optimally among different retirement accounts.

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. The Standard Poors 500 SP 500 for the 10 years ending December 31 st 2021 had an annual compounded rate of return of 136 including reinvestment. This calculator only provides education which may be helpful in making personal financial decisions.

Interest is computed on the current amount owed and thus will become progressively smaller as the principal decreases. Using our 401k Growth Calculator lets run through a quick example.

Catch Up Contributions How Do They Work Principal

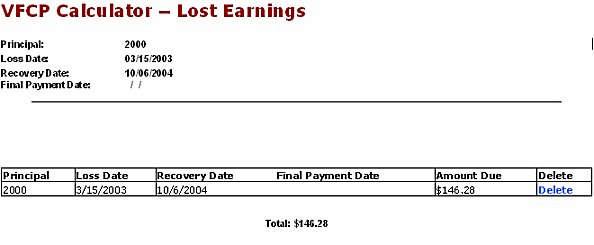

Voluntary Fiduciary Correction Program Vfcp Online Calculator With Instructions Examples And Manual Calculations U S Department Of Labor

30 Free Online Financial Calculators You Need To Know About Expensivity

Principal Amount Formula How To Calculate Principal Video Lesson Transcript Study Com

Calculate Principal And Interest Per Loan Payment Excel Shorts Youtube

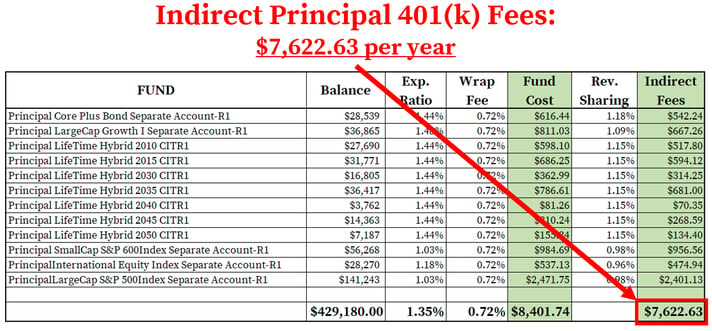

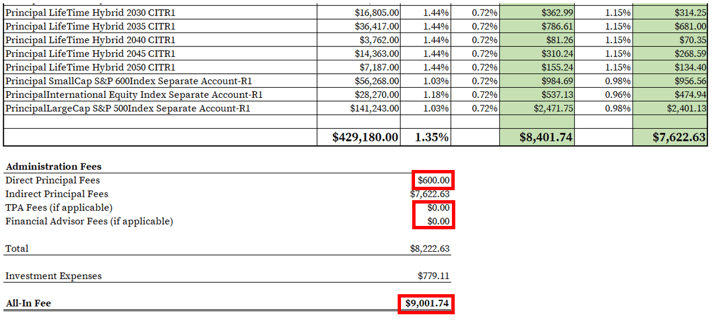

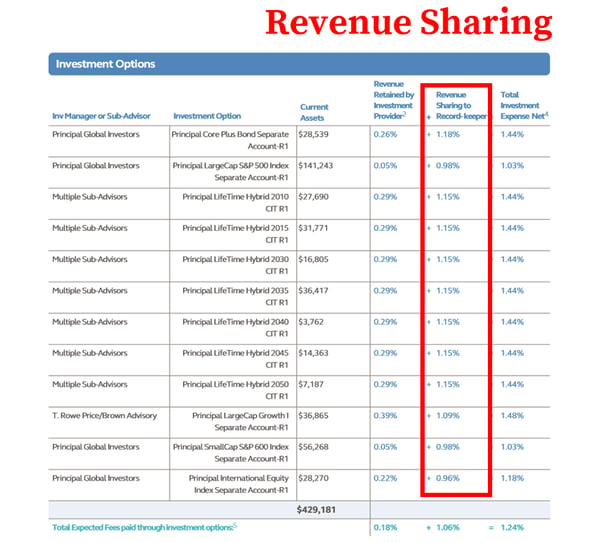

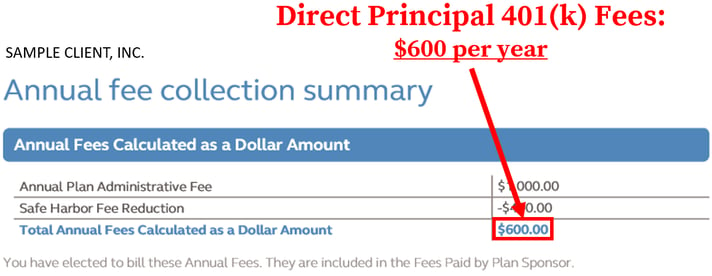

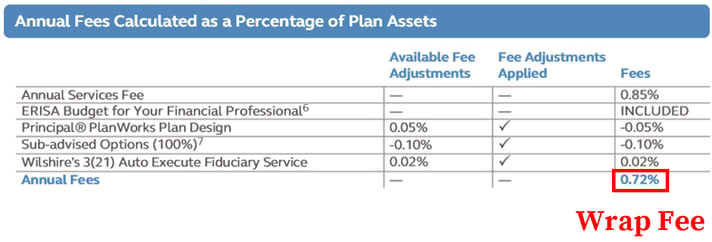

How To Find Calculate Principal 401 K Fees

How To Find Calculate Principal 401 K Fees

Extra Principal Payment Calculation Financial Calculator

Retirement Calculator Sams Investment Strategies

Amortization Schedule Calculator Equal Principal Payments

How To Find Calculate Principal 401 K Fees

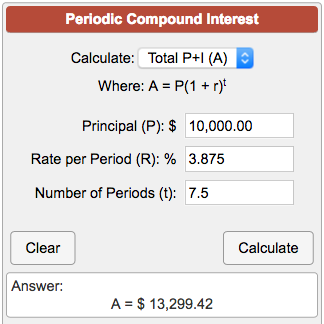

Periodic Compound Interest Calculator

How To Find Calculate Principal 401 K Fees

How To Find Calculate Principal 401 K Fees

Use This Free 401k Loan Calculator To See If A 401k Loan Is Right For You

Principal Amount Formula How To Calculate Principal Video Lesson Transcript Study Com

How To Find Calculate Principal 401 K Fees